Chipotle Investment Thesis

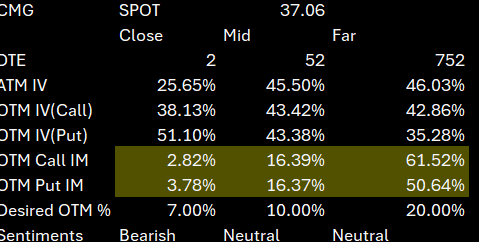

Before we get into this thesis, I want you to think of something in the sense of a game. Let's say every 30 days you have around a 70-80% chance of being paid a premium to own a good company would you play? The average person would say yes, this sounds like a one-sided game towards the owner and would want to participate taking on that 20% risk of not making money. Now let's move this fantasy game into a real market scenario. Chipotle (CMG) is one of the worst performing S and P stocks of the year bringing investors a return of around -40%. Investing in a company down this much can be very risky and volatile but I am here to try and show you the benefits of owning CMG. CMG has a neutral to bullish outlook for the next two years and yes neutral to bullish is correct. Why would I write an investment thesis on a neutral stock? Well neutral to slightly bullish stocks are the perfect environment for writing calls AKA covered calls. Essentially you the owner write calls on your shares collecting a premium shorting the call at a certain strike. With the neutral outlook your calls should be relatively safe from any major breakouts but if this does happen it is not a big deal as you can wheel back into CMG. CMG has had concerns with consumers not eating out as much which is not fully true, we can see a steady increase in revenue constantly all the way back to 2018 and great expansion with solid real estate locations (mainly leases) with adaptive features to high demand such as the drive thru for on-the-go orders. CMG has always stood strong in the food business even during the pandemic which is very impressive for a food chain. CMG is also capitalizing on the emerging markets placing them in relatively smaller cities showing nice expansion across the country. Circling back to the neutral bullish outlook thesis which derives from the weight of each stage in implied volatility (IV) being at the money, and both out the money call and put of the same percentage. Weighing the IV of these three options we can see the ATM has the highest IV meaning the market is hedging for a more neutral outlook with the call IV being slightly under at the money but way above the put IV meaning the market is also pricing in a little bit of an uptrend. CMG long call IV shows us that a bullish trend is still in the looks but not a massive one and that is perfect for the investment strategy of this article as we will be using this neutral movement to decay our short calls, we are selling to people to collect premiums. CMG has had a massive overreaction in my eyes, and this investments strategy will provide you positive gains on a slight uptrend while still having equity which is another beauty of the covered call. Performing this strategy takes capital and a understanding of option Greeks especially delta. Delta has many meanings, but my favorite use of this number is viewing it as the percentage of the certain contract to expire in the money bringing it value. Selling calls, you want to stay around a .20-.30 delta which is where the percentages from the game earlier come from. Example I own 100 shares of CMG at $30 a share I sell a call at the $40 strike collecting a premium and the delta was .25 meaning the buyer has a 25% chance of this contract being worth something at expiration and I the seller have a 75% chance of it being worth nothing meaning I keep all of the premium. Sellers want the contract to expire worthless as it is a short on the call contract. Strategy's especially involving options are never risk free so going over the possible risks of the covered call are as follows. Covered calls are one of the safest options if not the safest as the risk comes from the idea of cost basis on your underlying share price and the strike in which you sold the call. Selling a call above your cost basis is always smart as the mechanics behind the option contract is if the underlying goes above your short calls strike you have to sell your shares at the strike price. Tracing back to the example earlier if I had my 100 shares so CMG at $30 a share and sold the call for 28$ a share and it expired above the strike ($28) I would then sell my shares at $28 bringing me a 200-dollar loss minus the premium for my P/L. Avoiding this is as easy as selling the call at $31 so if assignment happens you still make money on the sale of your shares. CMG has the perfect environment for covered calls as it has a beautiful business in selling healthy food at a good rate and the numbers are there with constant revenue y/y growth and very solid debt control being close to a net cash position overall. Selling calls on CMG can be a smart move but of course this is not financial advice so invest at your own risk. My thesis is selling covered calls on CMG whilst being slightly bullish on the underlying overtime making it a buy in my portfolio.